Understanding Health Insurance is crucial in today’s health-conscious society. With the constantly evolving landscape of healthcare costs and services, having a solid grasp on health coverage is more important than ever. This quick guide is designed to shed light on the essentials of health insurance, illustrating why adequate coverage is not just beneficial, but essential for financial security and better healthcare outcomes.

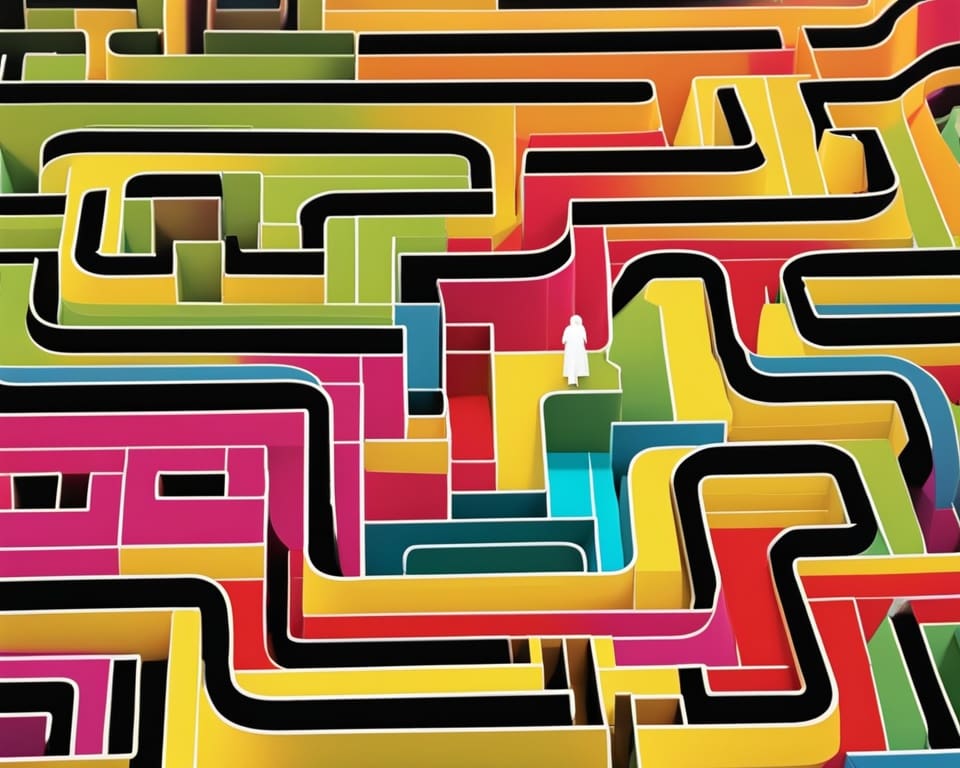

As outlined by the Centers for Medicare & Medicaid Services, navigating through the diverse options and regulations available in different regions of the United States can dramatically impact your choices. This article aims to demystify health coverage explained, empowering readers to make informed decisions for themselves and their families.

Health Insurance Basics: What You Need to Know

Understanding health insurance is crucial for anyone navigating the complexities of healthcare today. Familiarizing oneself with health insurance basics can greatly enhance your ability to make informed decisions. Recognizing the components of health insurance empowers individuals to find the right coverage while minimizing unexpected costs.

Defining Health Insurance

Health insurance serves as a contract between an individual and an insurance provider, designed to cover medical expenses incurred by the insured. This coverage typically extends to doctor visits, hospital stays, surgeries, and prescription medications. Grasping the essence of defining health insurance helps individuals appreciate its role in managing healthcare expenses, especially in a country where medical costs can be prohibitively high.

The Importance of Health Coverage

The significance of health coverage cannot be understated. Access to reliable health insurance ensures that individuals receive care without facing financial ruin. It plays a vital role in maintaining health and well-being, providing peace of mind during medical emergencies or unforeseen health issues. Understanding the importance of health coverage promotes better health outcomes and fosters a society that supports its members’ wellness.

Common Health Insurance Terms Explained

Familiarity with health insurance terms can enhance your ability to navigate the plans available. Here are some commonly encountered terms:

- Premium: The amount paid monthly for health insurance.

- Deductible: The out-of-pocket cost that must be paid before insurance coverage begins.

- Copayment: A fixed amount paid for a specific service or prescription.

- Network: A group of doctors and hospitals contracted with the insurance provider.

Understanding Health Insurance: A Quick Guide to Types of Plans

Health insurance is a crucial aspect of managing both health and finances. Different types of health plans can cater to various needs, from those provided by employers to individual offerings and government assistance programs. Understanding these options empowers individuals to make informed decisions about their healthcare coverage.

Employer-Sponsored Plans

Employer-sponsored plans represent one of the most common types of health plans in the United States. Typically, these plans offer comprehensive coverage for employees and, in some cases, their families. Many employers contribute to the premium costs, making these plans a cost-effective choice. The collective nature of employer-sponsored plans allows for lower rates due to pooled risk, making access to healthcare more affordable for the workforce.

Individual Health Insurance Plans

For those not covered by employer-sponsored plans, individual health insurance plans offer alternatives that can be tailored to personal needs. These plans provide flexibility in selecting coverage levels, types of services, and premium amounts. Individuals can choose from various options, allowing them to find a plan that fits their unique health requirements and budget.

Government Programs: Medicaid and Medicare

Government programs play a significant role in providing healthcare coverage for many Americans. Medicaid assists those with limited income and resources, ensuring they receive the necessary medical care. Medicare serves senior citizens and individuals with certain disabilities, offering additional support for healthcare expenses. Understanding these government programs enables individuals to grasp their eligibility and the benefits available to them.

Navigating Health Insurance Benefits and Copayments

Understanding health insurance benefits is essential for making informed healthcare decisions while keeping out-of-pocket costs low. Each health plan varies, but it typically includes vital coverage such as preventive services, emergency care, specialist consultations, and hospital stays. Familiarizing yourself with these benefits helps not only in planning your healthcare effectively but also in maximizing the advantages your plan offers.

A crucial aspect of navigating health insurance is understanding copayments. These are fixed amounts you pay for specific services or medications at the time of receiving care. Knowing how copayments work and what services are subject to them can significantly impact your budgeting and financial planning for healthcare expenses. By being aware of your plan’s copayment structure, you can better prepare for each visit and avoid surprises when the bills arrive.

Remember, the more you understand your health insurance benefits and the copayment obligations that accompany them, the better equipped you will be to make health-related choices that accommodate both your needs and your finances. Engaging with your plan proactively can set you on a path to not just survival but thriving in your health journey.